Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the. EPF CHALLAN CONTRIBUTION RATE 25 EFFECTED from 1june-18 TO till.

How Epf Employees Provident Fund Interest Is Calculated

The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the Central Board of Trustees CBT meeting held today states Gangwar.

. Epf contribution rate 2018 Pf Interest Calculator Hotsell 50 Off Www Ingeniovirtual Com Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax. 3667 No more option of contributing 8. Epf contribution rate 2018.

This is called contribution towards. Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPF. Employee or Voluntary Provident Fund The employee can voluntarily pay higher contribution above the statutory rate of 12 percent of basic pay.

Employer must make monthly payment on or before 15th of the month. The reduction was announced in 2016 after the tabling of the revision of Budget 2016 by PM Datuk Seri Najib Razak. Revised Rates of Contribution to various PF Accounts wef.

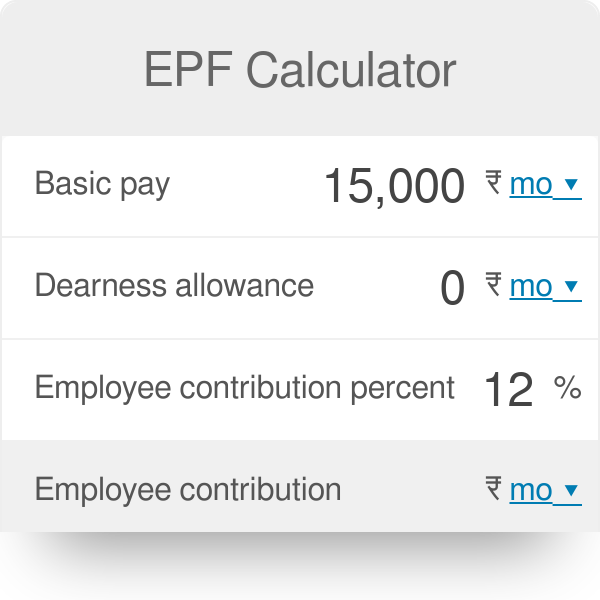

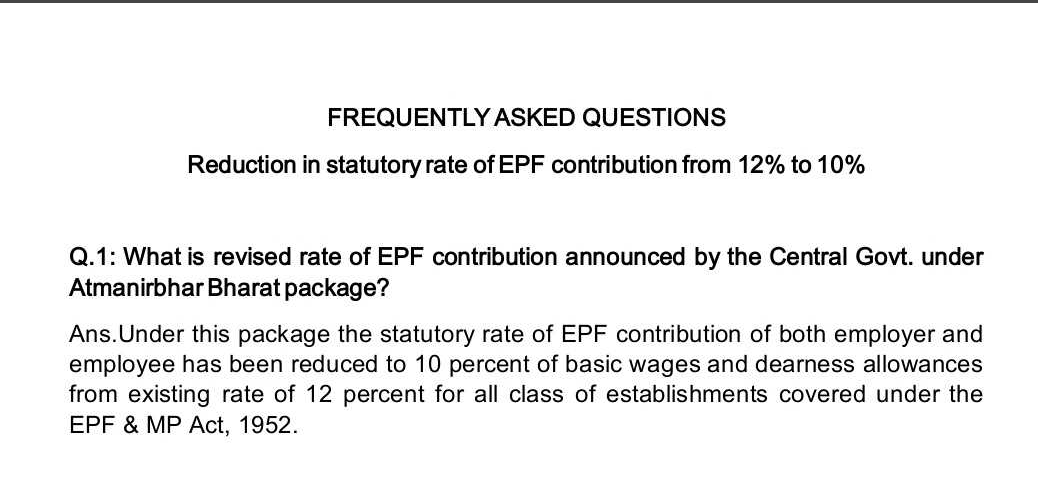

Which are in effect from 1st June 2018. Reduction in rate of epf contributions from 12 to 10 of basic wages and dearness allowances is intended to benefit both 43 crore employees. Employees contribution towards EPF 12 of 30000 3600 Employers contribution towards EPS subject to limit of 1250 1250 Employers contribution towards EPF.

Salary for January 2018 Therefore the Contribution Month is February 2018 and it has to be paid either. Mandatory Contribution Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. In line with the recent amendment reduction in PF Admin charges notified by the EPFO the revised.

Employee Pension Scheme EPS 833. Effective January 2018 wagesalary February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 per cent for. Percentage of contribution Employees Provident Fund.

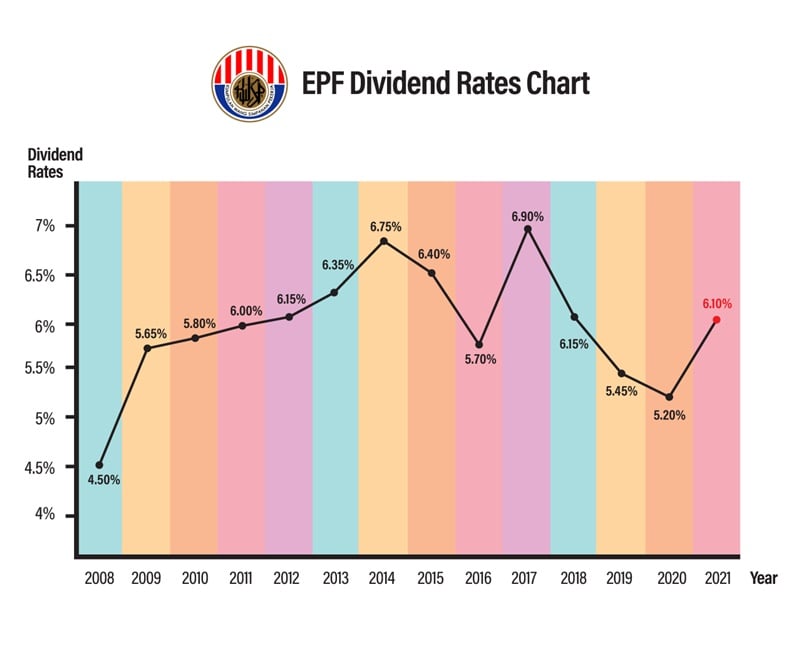

It looks like the Employees Provident Fund EPF will be changing its employee statutory contributions rate back from 8 per cent to its original 11 per cent. For 2021 the EPF dividend rate was 610 for conventional savings and 565 for shariah savings surpassing the previous years EPF dividend performance of 520. ESIC EPF CONSULTANT LABOUR LAW ADVISORY FSSAI LICEANCE OTHER.

Effective January 2018 cycle February 2018 EPF. Effective for salaries from. EPF Contribution Rate 2022.

Yusof Mat Isa Next year the Employees Provident Fund EPF contribution rate by employees will revert to the original 11 percent for members aged. Effective January 2018 cycle February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 for members below age 60 and 55 for those. KUALA LUMPUR Dec 21.

Epf 8 Vs 11 Which Is The Best Choice For You

The Relationship Between Economic Growth And Employee Provident Fund An Empirical Evidence From Malaysia Document Gale Academic Onefile

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf Rate Of 8 1 Approved By Govt Epfo To Credit Interest Soon Mint

Latest Pf Interest Rate Updated For 2018 19 Planmoneytax

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Employee Provident Fund Epf The Complete Guide By Koppr Medium

Newsletter 33 2017 Epf Contribution 2018 Page 001 Jpg

The State Of The Nation Should Epf Tax Relief Be Reduced Next Year The Edge Markets

Epf Contribution Rates 1952 2009 Download Table

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Calculator Employees Provident Fund

Reduction In Statutory Rate Of Epf Contribution From 12 To 10 Faqs

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India